British Columbia’s provincial government brought down its 2019 budget Feb.19 that includes substantial new money for measures aimed at spurring, ensuring and supporting long-term growth.

The Ministry of Finance has assembled a three-year fiscal plan in which the province is expected to spend and see about $31 billion invested from taxpayer and self-supported i.e. revenue-driven resources over this period on capital projects. A majority of that spending will be taxpayer-funded. But there are also business incentives in the new budget.

Record public capital spending

The B.C. government will be outlaying $20.1 billion—which it said is the province’s largest-ever taxpayer-financed capital plan—to expand and sustain infrastructure, including hospitals, post-secondary facilities, schools and transportation. The funds will support existing approved and new projects.

The fiscal plan total is $4.3 billion higher than the 2018 budget mainly due to new education, health and transportation capital spending, as well as revised timing for capital projects. A portion ($2 billion) will be supplied by the federal government.

Here are several examples of taxpayer-funded projects:

A new and seismically safer Burnaby North Secondary School has been approved for up to $79.2 million. It will have 1,800-seats and include space for child care, adult education and language development programmes. It is expected to be ready for students in Sept. 2021;

A new $126 million Sustainable Energy and Environmental Engineering Building at the Surrey campus of Simon Fraser University that will provide space for 515 students, expand research opportunities and foster innovation;

The new St. Paul’s Hospital at the Station Street site in Vancouver. It will comprise of a new core hospital (acute care and outpatient centres), capacity for 548 inpatient beds, a larger emergency department, surgical suite, consolidated specialty outpatient clinics and an underground parkade. Procurement is planned to start in fall 2019, with construction planned to start in fall 2020 and expected to complete in 2026;

The Broadway Subway, which will extend the TransLink SkyTrain system 5.7 km from VCC-Clark station to Arbutus Street with six stations, including a connection with the Canada Line. Construction is anticipated to begin in 2020 and finish in 2025 at a cost of $2.83 billion; and

Replacing the R.W. Bruhn Bridge on Highway 1 in Sicamous with a five-lane structure, including four-laning the approaches, a new roadway under the bridge to increase connectivity, a multi-use path and intersection improvements.

The B.C. government is taking steps to ensure that its own facilities are in excellent shape and that they meet evolving needs. The 2019 budget includes $1.6 billion in capital spending by government ministries over the plan period. The funds will be used to maintain, upgrade and expand infrastructure such as courthouses, correctional centres, office buildings, the Royal BC Museum and information systems.

Higher self-supporting capital spending

Self-supported capital spending is projected to total $11 billion over the fiscal plan period. The lion’s share (94 per cent) will be spent on electrical generation, transmission and distribution projects to meet growing customer demand and to enhance reliability. The system, largely provided by BC Hydro, was built from the 1960s through the 1980s. BC Hydro is upgrading and maintaining aging assets and building new infrastructure. Included in the electrical power investment is construction of a third dam and hydroelectric generating station on the Peace River through the Site C Clean Energy project and the purchase of Fortis’s partnership interest in the Waneta Dam expansion facility south of Trail, B.C.

Here are other major self-supporting projects:

$300 million for BC Lottery Corporation projects, including replacement of key legacy business systems, expansion of the lottery distribution network and acquisition of gaming equipment to support lottery, PlayNow internet gaming, casino and community gaming activities;

$172 million for Insurance Corporation of British Columbia projects, including investment in IT and facility maintenance and upgrades; and

$180 million invested by the Liquor Distribution Branch for costs related to the Liquor Distribution Branch Warehouse project, updates and improvements to liquor stores and expansion of cannabis stores.

Business incentives

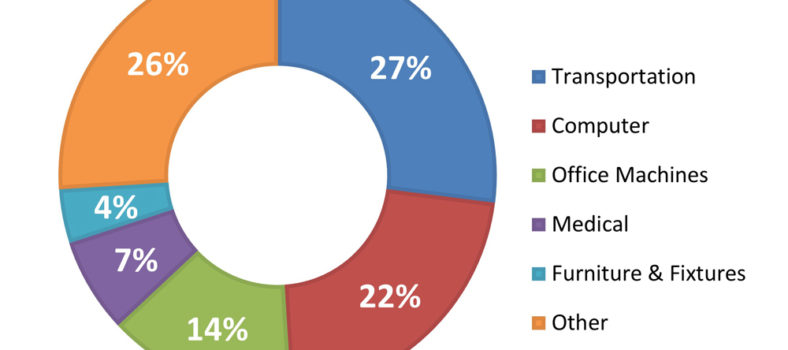

In a new programme British Columbia will contribute over $800 million over the fiscal plan for investment incentives in capital assets, such as buildings, machinery and equipment. This move it said will make it more attractive for businesses to invest in assets while freeing up their capital.