By Brendan Read

Traditional ownership of assets and financing for notably automotive, office equipment, healthcare and agricultural products may soon become obsolete, tossed into the recycling bin.

In its place will be product-as-a-service, or pay-per-use assets, also known as servitization. Servitization is an alloy of changing customer preferences to an on-demand model, like for software and consumer products with new technologies, such as telematics and the Internet of Things (IoT) and practices. It expands on leasing by being open-ended, removing the fixed terms and the requirement to turn in the equipment at the end of the period.

Asset finance technology company White Clarke Group (www.whiteclarkegroup.com) released a report, Focusing On Customer Outcomes Through Servitization 2019, in partnership with the Aston Business School’s Advanced Services Group, that examined the depth, expansion and implications of the model. One that is outcomes-based (like processing raw materials, moving earth, reaping crops, fulfilling orders, transporting people and goods and diagnosing patients) rather than product-based (owning or leasing).

Servitization has disruptive implications across the asset finance markets, but also the manufacturing and distribution industries, including dealerships. It presents new opportunities for all players, including independent finance companies and FinTechs. It also promotes and supports “going green” by minimizing having to create new products and reducing the waste stream by extending the life of and reusing products that also appeals to customers.

“There can be little doubt that customers are increasingly attracted by the prospect of paying to use, rather than paying to own, certain assets [with servitization]. Correctly formulated service-based models of finance are much more likely to meet their needs,” said Brendan Gleeson, Group CEO of White Clarke Group, in the introduction to the report.

“On the other hand, the transition to services also brings significant complexity for pioneers, who will need to acquire new skills and learn to manage new types of risk. [But] the return for those who acquire those skills quickly promises to be great.”

“Companies in the asset finance sector have traditionally competed on product, price or total solution,” added Tim Baines, Aston Business School’s professor of operations strategy and executive director of the Advanced Services Group. “With servitization, there is a growing focus on customer intimacy and on providing the customer with the capability to achieve an outcome.”

Elements of servitization

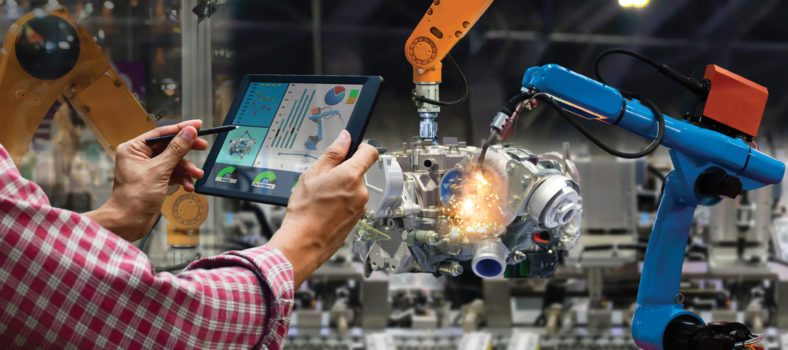

White Clarke Group defines servitization “as a conscious strategy to merge manufacturing and integrated services, offering to provide value-driven outcomes that are both scalable and resilient. This can include auto subscription services offered on a pay-per-mile basis, medical equipment where assets such as scanning machines are leased on a pay-per-scan basis and robots on production lines offered as pay-per-pick.”

The report said the move to servitization will require manufacturers to shift away from only offering traditional services, such as overhaul, parts and repair, to advanced services that focus on ensuring outcomes. But to do that companies have to explore new business models that incorporate the following three elements.

1. Changing customer expectations. Business customers are seeking value for money, greater flexibility, simplicity, a seamless one-stop offline and online omni-channel shop, transparency, security and compliance as well as peace of mind. They are focusing on their core business activities. Additionally, driven by growing consumer concerns about environmental sustainability, they are looking for societal and brand benefits.

2. Drivers for manufacturers. Many manufacturers now recognize that focusing only on product-led strategies risks missing out on the opportunity for much greater growth. Servitization could provide them with new additional greater and more consistent sources of revenue and profits. There are opportunities for these businesses to increase service revenue penetration, tap second and third life resell/re-lease markets and to improve customer retention, including better understanding of and predicting their needs.

3. Increased focus on environmental issues. Customers are increasingly seeing and want to see the economy move from a linear economy (make/use/dispose) to a circular economy, where products are reused or redeployed. Servitization enables this change by altering the dynamics of the trade cycle, potentially removing the triggers for replacing older assets.

Manufacturers that are accordingly focused on servitization can make their products easier to repair and upgrade by using modular designs. It will also require them to invest in new technologies, including sensors and telemetry i.e. IoT-enabled smart assets and to connect with high-bandwidth e.g. 5G networks. These companies must also have the ability to consolidate and integrate asset-related disparate data sources and to disintermediate solution offerings and re-bundle them efficiently and cost effectively. They must incorporate micropayment capabilities, along with more flexible billing solutions.

At the same time, manufacturers must focus on and offer product lifecycle management services to ensure that the assets remain in optimum condition. This will enable product redeployment and re-use and end-of-life asset harvesting.

Finally, manufacturers need self service customer and partner interfaces. “Collaboration is key to [servitization] success, not competition,” said the report. “A partnership approach with different entities working in an ecosystem will be the most likely model to succeed in many sectors.”

Risk factors

For the added benefits, servitization does pose additional risks to manufacturer (or reseller) lessors. These include:

Added financial risk, from having to generate significant working capital as a result of not being paid in total and upfront for the products;

Legal and regulatory risks, such as from bundling heavily regulated services like insurance: which manufacturers may not want to take on. The report said that as a result customer contracts may have to be rewritten;

Operational risk, from likely, level of and nature of asset usage; and

Partner risk, from with integrating the partners within the manufacturers’ systems. Manufacturers would be taking on the partners’ performance and step in should a partner go out of businesses “or face reputational risk”. Manufacturers also may run the risk of competing with their captives and with their distribution channels for customer ownership and loyalty.

Servitization’s outcomes-based approach goes beyond leasing because there is no defined period of equipment use. But for that reason, the report pointed out, accounting rules may not see it as a lease and instead they may treat it more like a daily rental. Servitization is ahead of the regulators; it does not neatly fit into the current definitions, which will have to catch up to it.

Industry impacts

The White Clarke Group report identified servitization’s market impacts on key industry players.

Manufacturers. Companies in competitively intense markets and facing product commoditization could use it to increase margin. Meanwhile those that are in mature markets are seeing it as new ways to grow the business. Manufacturers and service providers are providing solutions that mix both new and used equipment, which, the report said, “provides an outlet for second life equipment, extending effective asset lives and lowering overall carbon footprint of production as well as reducing natural resource requirements.”

Captives. Manufacturer captive finance providers may shift their focus from finance towards sales, customer loyalty and new models of asset usage and the provision of services. “Captive finance providers are well placed to exploit the opportunities presented by servitization,” said the report. “They have many strengths which they can leverage to deliver these new services including, long term customer relationships, detailed knowledge of the industry and the assets and with the OEM [original equipment manufacturer], access to customer and asset data.”

Banks. Banks may be unwilling to compete for servitized equipment financing. Servitization now requires them to also understand usage and performance risks. Complicating the matter further is the unresolved question of who will own these new types of risk. “It will be difficult for banks to manage and quantify such risks in their current processes and risk management committees,” noted the report.

Instead, banks may concentrate on providing funding and managing credit risk. They “may also have better credit ratings and access to lower costs of funds that can be leveraged by the manufacturer. Additionally, banks may have spare systems capacity that the OEMs can also take advantage of at a competitive cost.”

Independents. Servitization offers an opportunity for independent financiers to serve smaller businesses that lack the access to finance this new model, supported by the democratization of data. But they will need to develop knowledge of the asset and the industries.

FinTechs. The opportunities for FinTechs lies in traditional financial institutions being constrained by legacy systems, regulatory worries and resistance to change that prevent them from developing internal servitization solutions. “The traditional full service software solution market designed for funders offering a range of finance services to meet all the needs of specific customer with exclusive use by one financier is ripe for disruption,” said the report.

FinTechs can nimbly develop attractive unique offerings that focus on the customer journey that cannot be commoditized. But it will require “access to strong and flexible systems that can access the relevant equipment data and measurements and to be able to combine this with flexible asset level billing.”

Next steps

The White Clarke Group report, while comprehensive, noted that there is still more research that needs to be undertaken into servitization. These include understanding the financial impact (working capital requirements revenue recognition), on the legal impacts (understanding taxation and establishing contracts for partners and customers) and on pricing. There also needs to be an examination of the effect on dealers. Servitization may entail business process re-engineering: identifying the opportunities to use new technologies, such as artificial intelligence (AI)-based machine learning.

Finally, further research is needed into organizational culture from sales to service. The report pointed out that organizational cultures are hindering the needed technology changes to enable the shift to servitization based models.

“As with many changes affecting the industry at present, we recognize that technology lies at the heart of servitization,” said Gleeson. “We are at the start of the servitization journey and have identified a number of pathways for additional related research to deepen our understanding of the impact, issues and opportunities afforded to us all by servitization.”