By Brendan Read

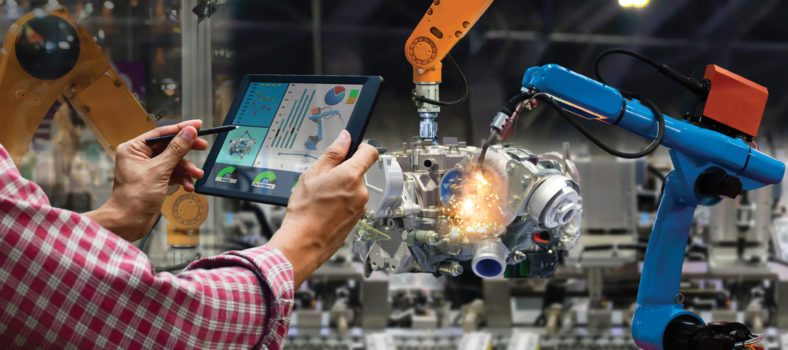

Robots are taking over the world. Just ask Alexa, or any other virtual assistant. Or when you get into your car: a fair amount of it has been built by their assembly-line “cousins”.

According to the Robotic Industries Association (RIA) (www.robotics.org), part of the Association for Advancing Automation (A3), there are over 250,000 robots in use in the United States, the third highest in the world, behind Japan and China. The RIA reported that a record number of robots—35,880 units—were shipped to North American companies in 2018, a 7 per cent increase over that in 2017.

The growth of robotics has continued even in the face of mounting concerns about the resiliency of the economy. In the second quarter 2019 alone, North American companies ordered 8,572 robots, valued at $446 million. This represents a growth of 19.2 per cent in number of robots ordered, and a 0.6 per cent boost in dollars compared to the same time period in 2018.

“Robot use continues to grow, which is helping make U.S. companies more competitive and leading to new job growth,” said A3 president Jeff Burnstein. “We are currently experiencing the greatest period of robot expansion in history—over 180,000 robots have been shipped to American companies since 2010—and more than 1.2 million new manufacturing jobs have been created during this time.”

Robots have also been marching beyond the realms of automotive companies and large global businesses, which have been their first and heaviest adopters. The RIA reported a 41 per cent growth in shipments to non-automotive companies, notably food and consumer goods, plastics and electronics.

“We are quite pleased to see other industries continuing to realize the benefits of automation,” said Burnstein. “Small and medium-sized companies are [also] using robots to solve real-world challenges, which is helping them be more competitive on a global scale.”

Industry impacts

But what are the implications for the equipment finance industry? The Equipment Leasing & Finance Foundation (The Foundation) (www.leasefoundation.org) commissioned The Alta Group to find out. Its findings were published in a study, Robots, Cobots and Finance, released in February 2019.

The Foundation study, citing IDC analysis, revealed that robotics is moving towards intelligence and autonomy, enabled by advances in artificial intelligence (AI), machine learning, in hardware like sensors and central processing units (CPUs) and in software and services. As a result, robots are beginning to learn and adapt to new information and report and self-diagnose problems. Robots also are now being expressly designed to work with people i.e. cobots, such as for feeding items into other processes, lifting and pick-and-pack operations. Together these developments are broadening the robot market.

“The convergence of robotics, artificial intelligence and machine learning are driving the development of the next generation of intelligent robots for industrial, commercial and consumer applications,” the study quoted Jing Bing Zhang, research director of robotics at IDC Manufacturing Insights. “Robots with innovative capabilities… [are] driving wider adoption of robotics in the manufacturing and resource industries and enabling new uses in healthcare, insurance, education and retail.”

These factors are driving the demand for robots, providing more profitable use cases for user businesses, but also for financing companies. The high capital costs will require all but the largest companies to seek outside resources to make these purchases.

But it isn’t just hardware companies are buying. Increasing sophistication is accelerating the growth of markets of software and services, both of which can be sourced in the cloud on a subscription basis.

Moreover, rather than as a capital expense, albeit one that increases productivity and reduces overall costs, robots can now provide a potential supplemental revenue stream, said the Foundation study. This is derived from the data the equipment obtains through their sensors. This is opening the door for more managed solutions transactions (MSTs) that combine robotic hardware, software and collected data.

“At the end of the day, the real question is whether robotics will increase financing volume, or will these gains be offset elsewhere as robots replace standard equipment operated by human workers?” asked the study. “The jury is still out on this issue, but Alta’s research indicates that, while changing job demographics, increased robotics utilization will not be dilutive, as the new jobs and businesses being generated through adopting robots will generate more, rather than fewer, financing opportunities.”

Moderate/low risk factors

As with other advanced equipment, like industrial automation, increasingly sophisticated robots raise the asset risks. These stem for technology, including autonomy, programming and data ownership, which vary depending on the application and market. Even so, the risks with robots are moderate to low, said the Foundation study.

Here are, in summary, the key risks:

Credit. Robotics does not by itself change transaction risks. But like other advanced equipment factors, such as MST use, technology changes that impact residual values and size of the buying business will change credit risks. “An entity that seeks to finance robotics…should not need to adjust its credit policies and processes because it is financing robotic equipment”;

Legal. The key issue is vicarious liability as a result of human interaction with robots. But this is no different, fundamentally, from other equipment. Having national standards may be the only answer to avoid injuries and large damage awards. “If there are adequate regulatory safeguards in place, lessors are likely to protect themselves in the same manner as before, even with the possibility of increased claims”;

Regulations. There are regulatory efforts underway in the U.S. that are primarily focused on human worker interaction safety. These include, potentially, safety and licencing standards and insurance requirements. But they may also include job protection. Licencing restrictions may eventually be extended from operators to repair and maintenance providers “due to the sophistication and complexity of the equipment”; and

Residuals. The key considerations are increasingly the cutting-edge technology and high reliance on the software. Changing and disruptive technologies also can change the value. And finding expertise to make those valuations can be challenging. At the same time the rise of integrating robotics into MSTs “makes it hard to strip out the asset and limits residual plays.”

“There will be increased regulation of robotic equipment, and these regulations may impact the growth of robot utilization,” noted the study. “Any impediments to equipment growth always affect financing opportunities but, for the various reasons discussed, the increased regulatory risk of financing robotics has been deemed moderate.”

Opportunity segments

The Foundation study examined five target industries—agriculture, healthcare, industrial, material handling, and transportation—plus an other category that included exoskeletons, nanobots, military applications and robotic process automation. The types of robotic assets, their characteristics and level of autonomy and their impact on the leasing and finance industry were examined.

“The primary conclusion drawn from this examination is that there are substantial financing opportunities in each of the primary industry segments analyzed,” said the study.

The study also evaluated growth potential of each industry segment, relative to the asset risk involved.

No matter the segment there will be opportunities for equipment financing firms that will move into them quickly become industry leaders. Those businesses with asset management skills with the rise of MSTs into robotics will be well placed to take a dominant position.

“Robotics are going to be a part of the change in how business is conducted in the future,” concluded the Foundation study. “Manufacturers and end-users certainly are being forced to recognize this truth. Consequently, so will the equipment leasing and finance industry if we are to continue to creatively meet the needs of our customers.”